Understanding the financial universe may seem complicated, but Serasa Score It is an important concept that can directly influence your chances of obtaining credit and the conditions offered for loans and financing.

In this article, we will explain what the Serasa Score is, how it is calculated and how you can consult it easily and for free.

What is the Serasa Score?

THE Serasa Score is a score that reflects your payment history and your relationship with finances.

Imagine you own a store and someone you don’t know asks you to buy something on credit. It would be great to have a way to know if they are trustworthy, right?

The Serasa Score does just that: it assesses people’s “good payment history”.

The higher the score, the greater the confidence of financial institutions in granting credit.

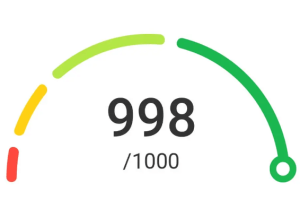

This score varies from 0 to 1,000 points and is used by banks and companies to decide whether or not to approve credit, in addition to influencing the interest rate offered.

If your score is high, you are more likely to get a loan with lower interest rates.

How is the Serasa Score calculated?

The score is calculated based on your financial history.

Paying bills on time, not accumulating debts and maintaining a solid relationship with financial institutions helps increase your score.

Delays and defaults can reduce your score, showing financial instability.

Keeping your information up to date also counts, as this demonstrates responsibility and organization.

Just as a cake needs time to rise, building a good score takes time and requires patience and financial discipline.

Why is the Score Important?

Your score is like a financial resume: it shows companies how trustworthy you are.

With a good score, you have a better chance of getting credit for purchases, loans and financing, and you can also benefit from lower interest rates.

A low score, on the other hand, indicates risk for institutions, making access to credit difficult and making it easier to refuse requests.

How to Check and Improve Your Serasa Score

Checking your score on Serasa is simple: just access the official website, register for free and check your score.

To improve your score, keep payments up to date, update your information, avoid debt and use credit responsibly.

Building a good score is like caring for a plant: it requires attention and consistency to grow over time.

Conclusion

The Serasa Score is an essential tool for keeping your financial health up to date and achieving your goals.

Understanding what it is, how it works and how to improve it can open doors to financial opportunities, such as financing and installment purchases.

With discipline and organization, you can maintain a high score and ensure the best credit conditions for your achievements.