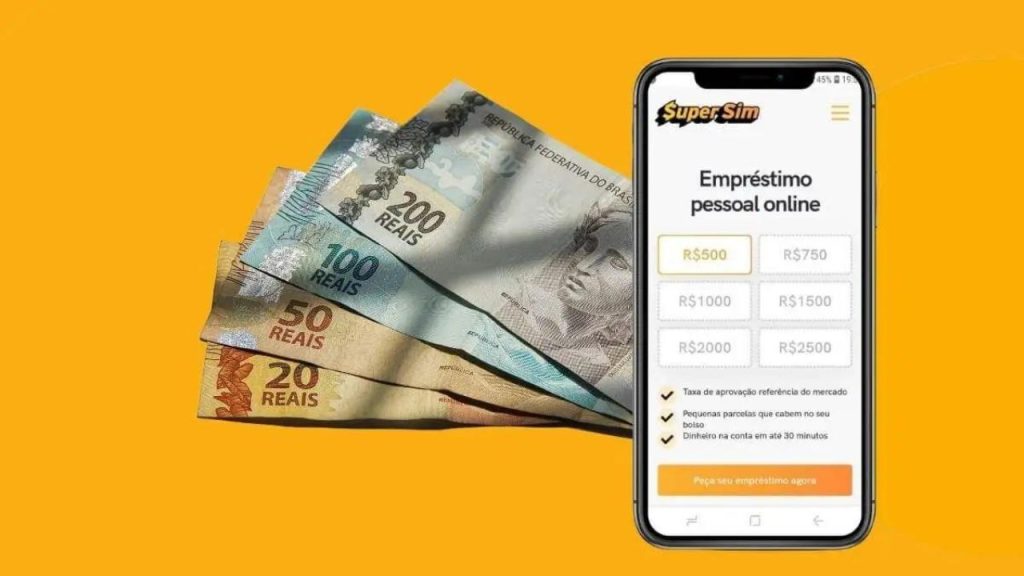

The time has come to find out how to apply for a loan, which can reach up to R$2,500. Don't waste any more time, check it out now!

If you are browsing this page, you have probably already decided to opt for SuperSim's online loan. Just start the application process, run the simulation and finish!

With SuperSim, all steps become more accessible. It is a completely digital platform that offers loans in a practical and secure way, aiming to facilitate the receipt of financial resources. After your loan is approved, in approximately 30 minutes, the amount can already be available in your account via Pix.

With rates starting from 14.9% per month, you have the opportunity to start solving any urgent issues you may be facing. However, it is important to remember that interest rates vary depending on the customer profile and the loan method chosen.

Who can apply for the SuperSim loan

Certainly, one of the main questions when considering obtaining a loan is: is it possible, regardless of the current financial situation?

The platform is recognized for reaching a vast portion of the population, providing loans even to individuals with a negative history in SPC and Serasa.

Even for those without restrictions but with a low credit score, the SuperSim online loan represents an opportunity to solve immediate financial issues or fulfill a personal wish.

It is important to highlight that personal loans at SuperSim are exclusively intended for people over 18 years of age who can prove their source of income.

Step by step guide to applying for a SuperSim loan

With the process carried out entirely online, there is no mystery to applying for your loan online with SuperSim. Plus, you won't have to wait in long lines.

SuperSim simplifies everything. It is an online platform that offers practical and safe loans to make receiving loans easier. After your loan is approved, in approximately 30 minutes, the money can be available in your account via Pix.

With rates starting at 14.9% per month, you have the opportunity to solve any urgent problems you may be facing. However, remember that interest rates vary depending on the customer's profile and the loan method chosen.

Who can apply for the SuperSim loan

Certainly, one of the main questions when considering applying for a loan is whether you qualify, regardless of your current financial situation.

The platform is recognized for reaching a wide variety of audiences, being able to grant loans even to individuals with a negative history in SPC and Serasa.

Even for those without negative records, but with a low credit score, SuperSim online loan provides an opportunity to solve urgent financial issues or take a step towards realizing personal dreams.

It is important to note that personal loans at SuperSim are exclusively intended for individuals over 18 years of age who can prove their source of income.

Step by step guide to applying for a SuperSim loan

With the ease of the process carried out entirely online, there are no secrets to requesting your SuperSim online loan, and best of all, you don't have to wait in long lines.

After providing your information, the platform will respond quickly regarding the approval of your loan, using artificial intelligence to speed up the process.

To ensure complete clarity, we have created a step-by-step guide to help you apply for your loan with SuperSim with peace of mind.

Discover the opportunity to borrow up to R$2,500.00

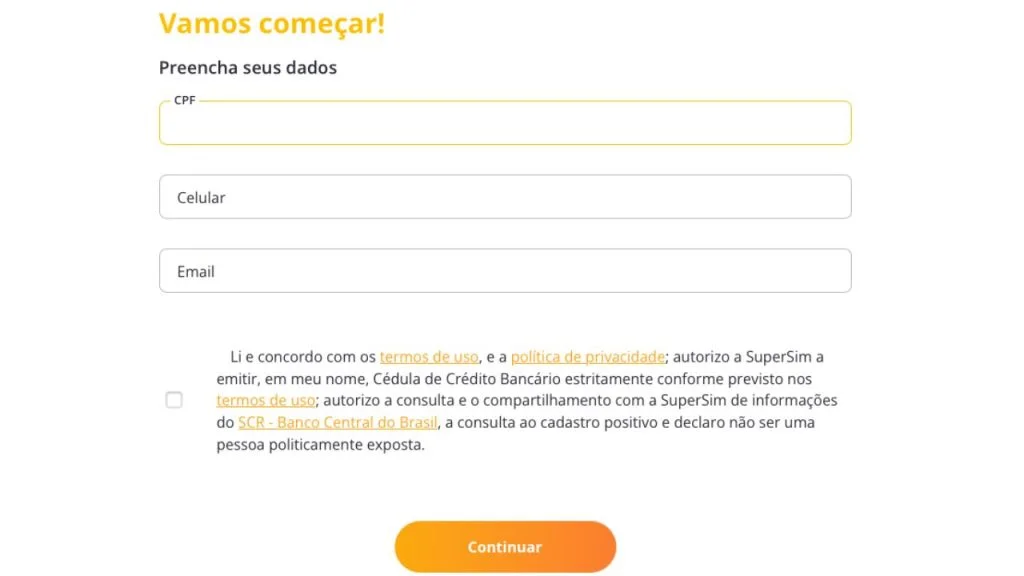

Step 1

When you enter the SuperSim website after clicking on a button during the article, you must fill in all your requested data (CPF, cell phone and email). Once this is done, check the box to accept the terms and press the continue button. Remember that the allowed values are between R$ 250.00 and R$ 2,500.

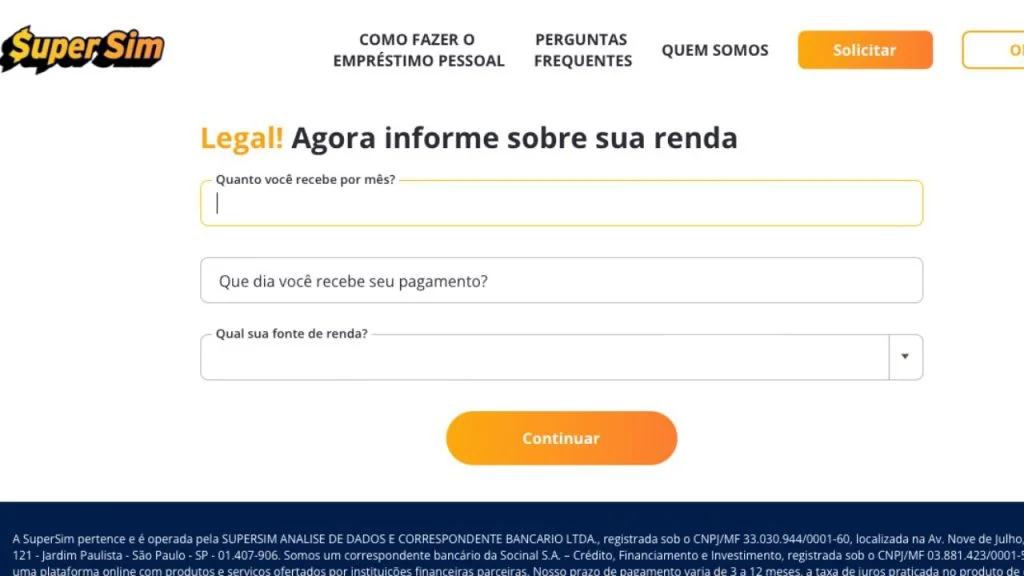

Step 2

On a new screen, it's time to talk about your income (remember that you need to prove it). Fill in the requested information, such as how much you earn per month, the payment date and your source of income.

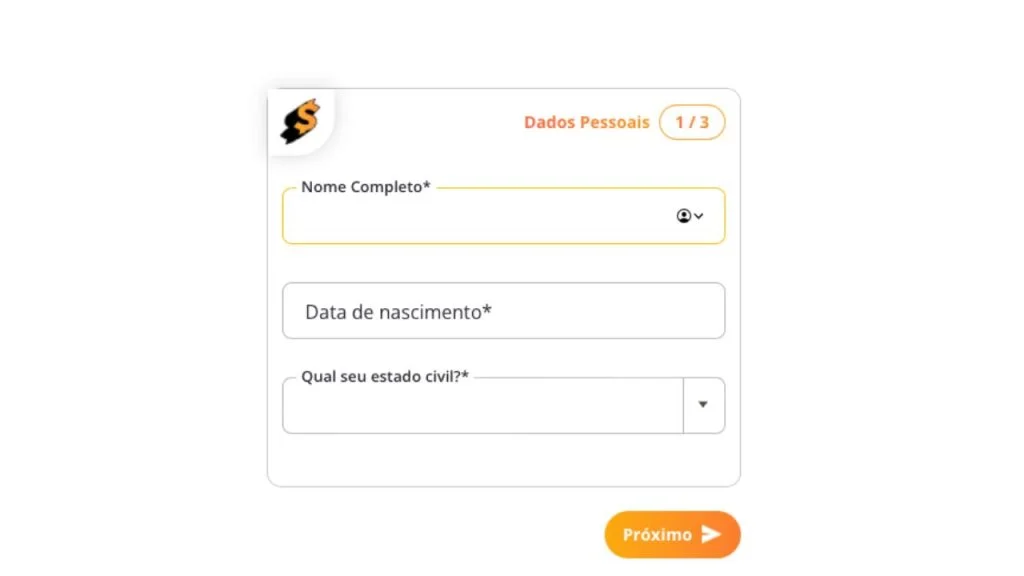

Step 3

Now you will have to provide your personal details to continue with the loan application. Name, date of birth and marital status. Next, you will be asked for your bank and residential details to complete the application.

Step 4

With all the information provided, the SuperSim system starts to evaluate your profile to determine the approval of your loan application.

The process usually takes less than 10 minutes to complete. If everything is in order and SuperSim grants approval, the money will be transferred to your bank account, registered during the process, in approximately 30 minutes.

APPLY NOW